Survey: Does Meeting the Tax Deadline Help You Land a Date?

Have you ever asked your dating app match when and how they file their taxes? Are they always on time? Do they know everything about it and maybe even teach others? Or do they have someone else do it for them?

Well, perhaps you should start asking (and making sure your own taxes are filed before April 15). At Hily, we wondered: how does Adult™ stuff like filing your taxes affect the dating life of young American adults? We asked 2,700 Millennial and Gen Z Americans about their taxes and dating, and here’s what we found.

Key findings:

- Half of young American daters see people who file their taxes early as more responsible potential partners.

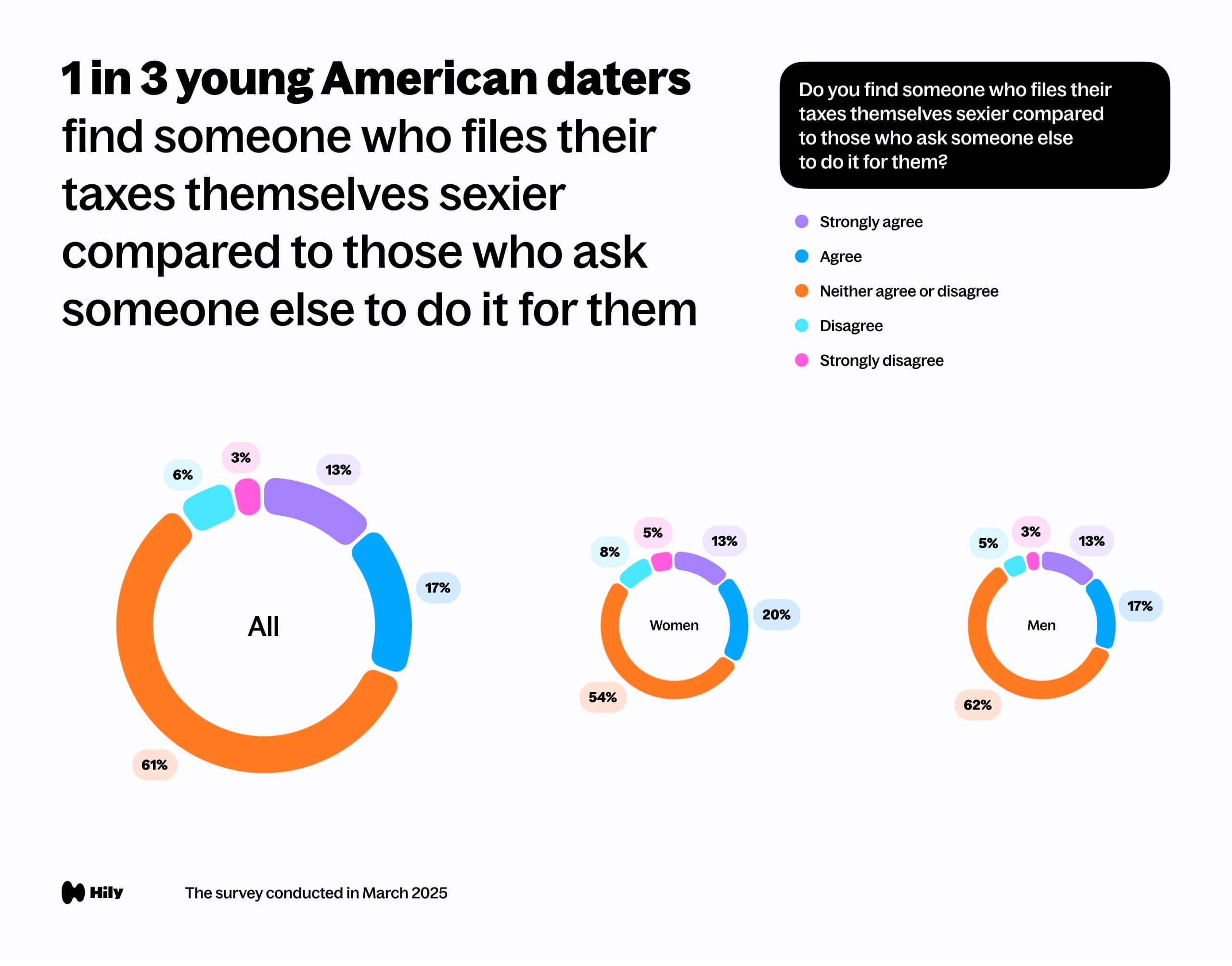

- For 1 in 3 young American daters, someone who files their taxes themselves is sexier compared to those who ask someone else to do it for them.

- Over half of young Americans are unlikely to decline a date during the tax season to file their taxes by the deadline.

- Among young American daters, 27% are likely to go on a date during tax season as an excuse to postpone filing their taxes.

- Roughly 1 in 3 young Americans are likely to specifically look for a tax preparer or accountant on dating apps to help them file their taxes during tax season.

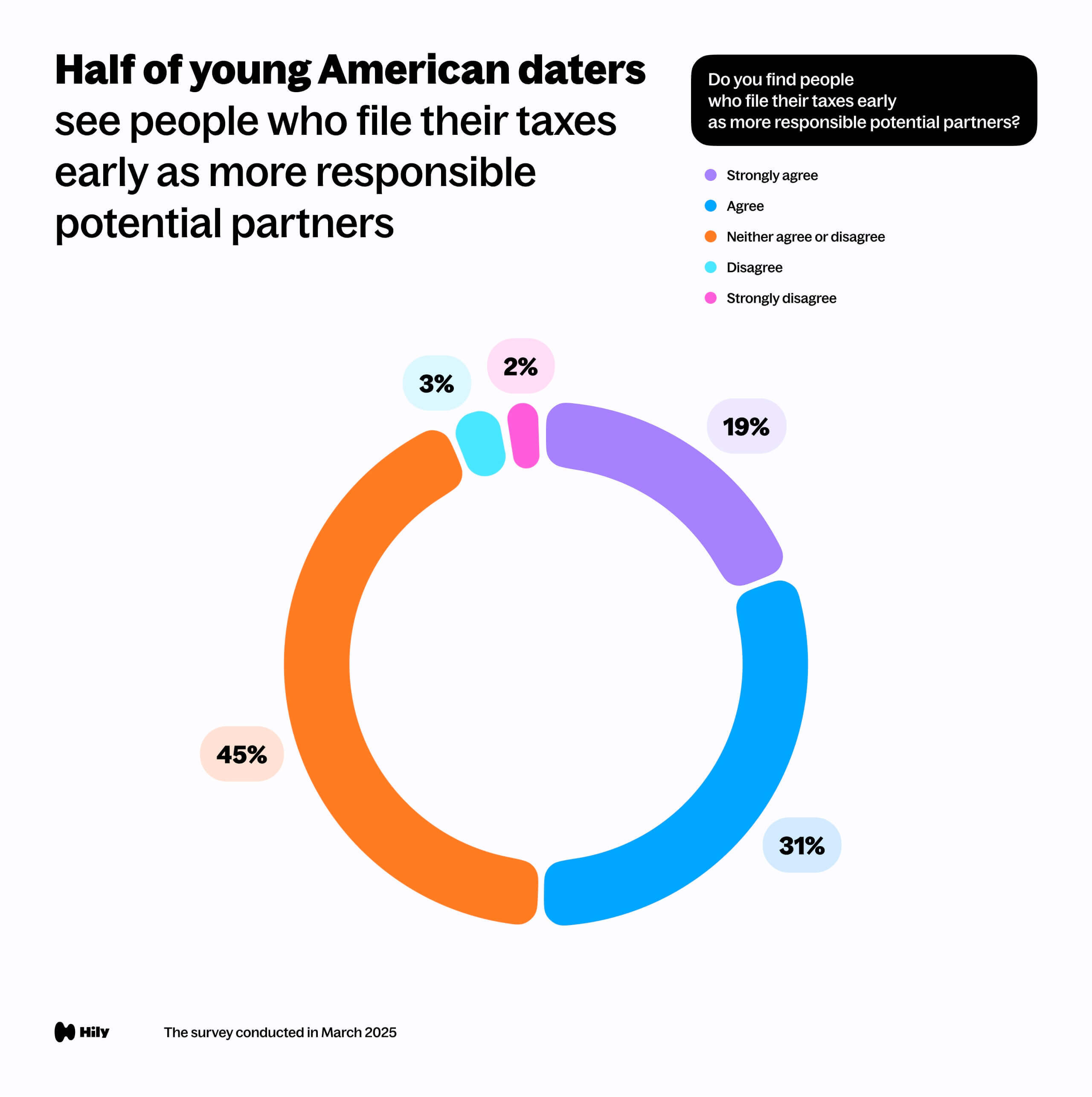

Young American daters seem to be inclined to associate diligence in tax filing with general responsibility. Half of those surveyed said they agree that people who file their taxes early are more responsible potential partners. Still, 45% more are neutral on the topic, and only 5% disagreed.

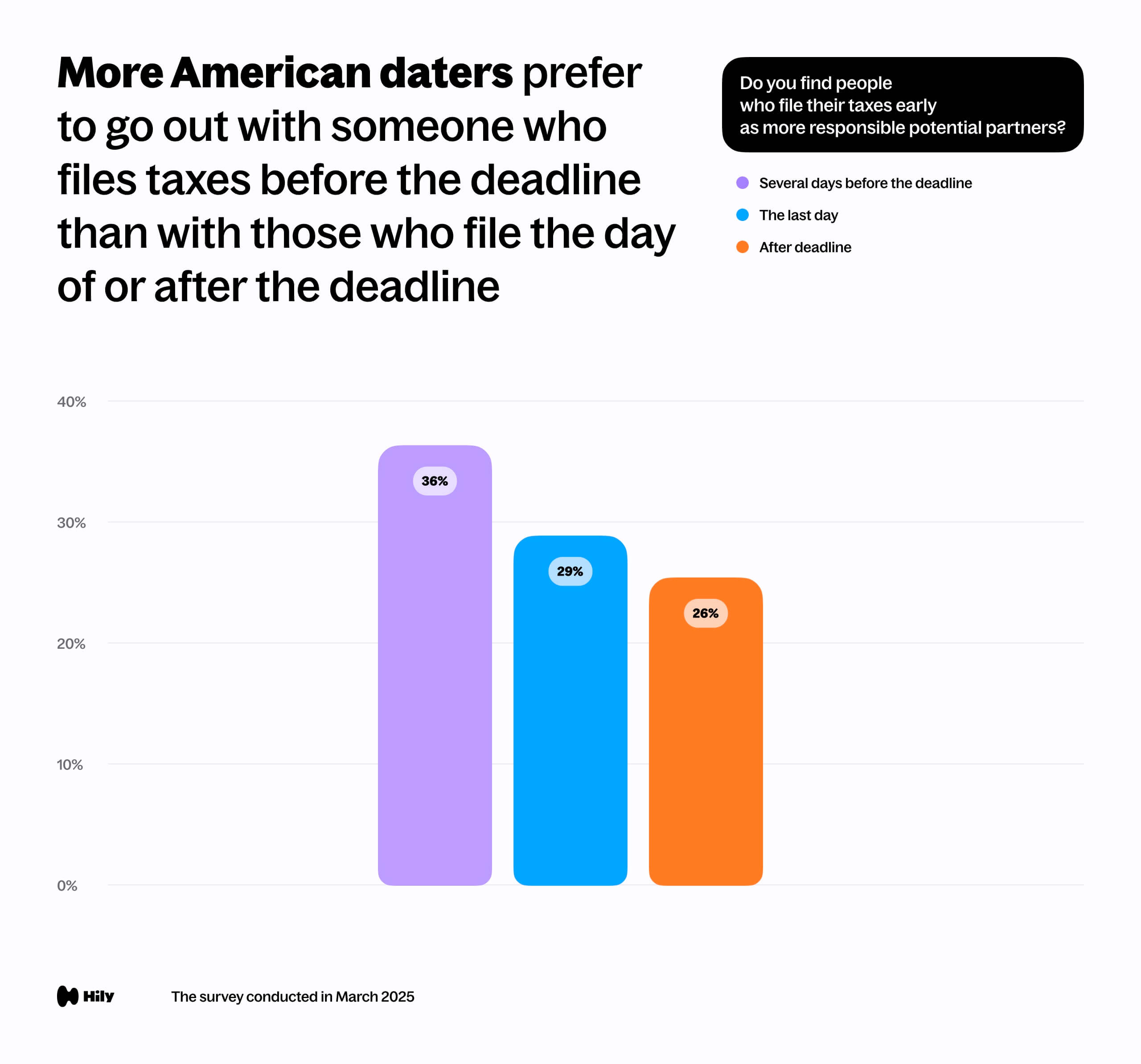

Young American daters seem to increasingly prefer partners who demonstrate responsibility when it comes to taxes. When asked how likely they were to go on a date with different types of tax filers, 36% favored those who filed several days before the deadline, compared to only 26% eager to date those who file after the deadline.

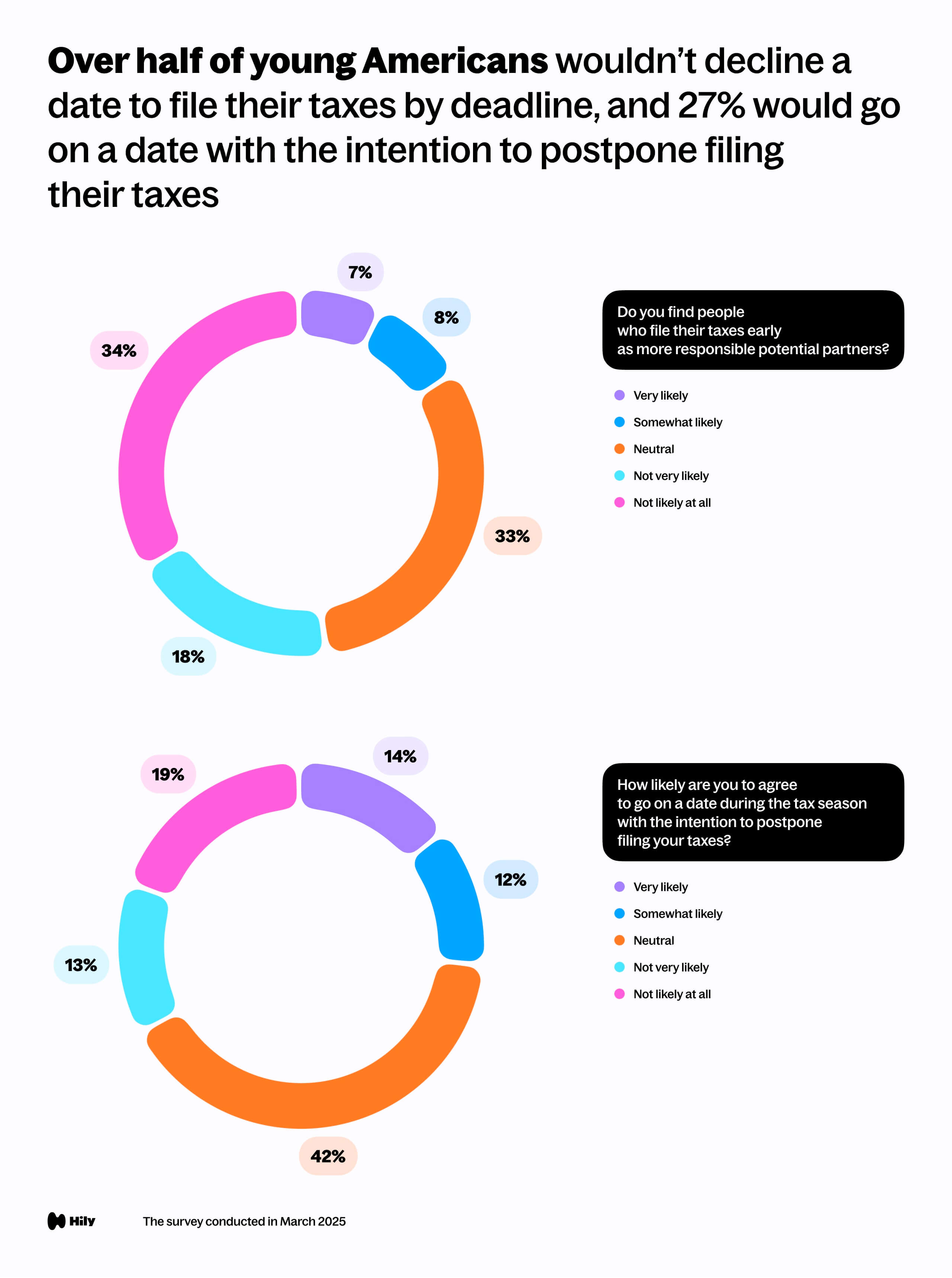

Even though tax filing habits seem to be somewhat important, very few young Americans prioritise filing their taxes on time over dating. A whopping 52% said they were not likely to decline a date during the tax season to meet the deadline.

Even more interestingly, dating actually serves as tax procrastination for some. Of those surveyed, 27% said they were likely to go on a date during tax season to postpone filing their taxes. However, 32% of young American daters said they were unlikely to do that, and 42% were neutral.

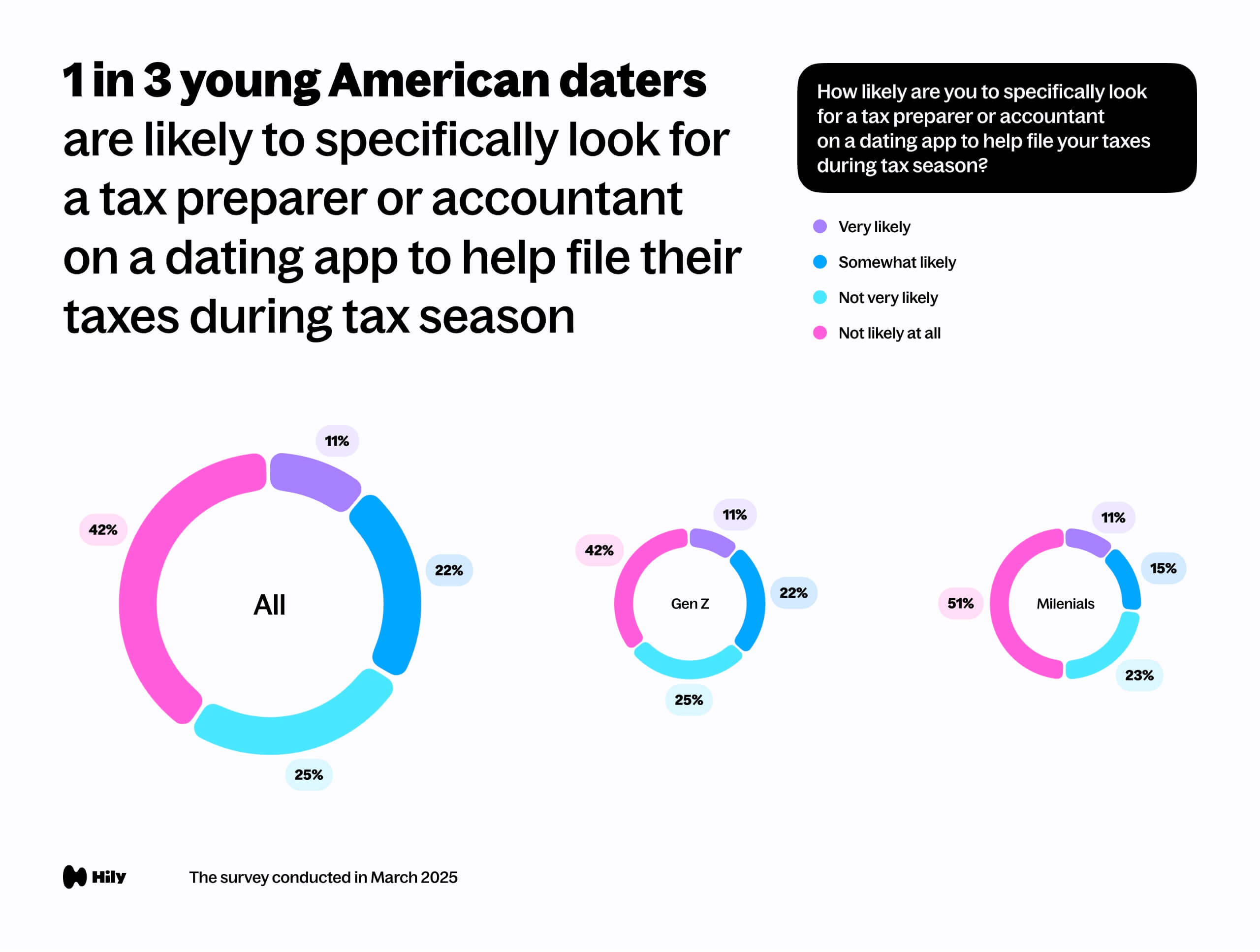

A significant portion of young American daters surveyed — 1 in 3 — actually say they’re likely to look for a professional accountant or tax filer on dating apps to get the benefit of help during the tax season. Gen Z seems to be more inclined to do this. Of those surveyed, 36% of Gen Zers said they were likely to look for such a person on dating apps to help with taxes, compared to 26% of Millennials.

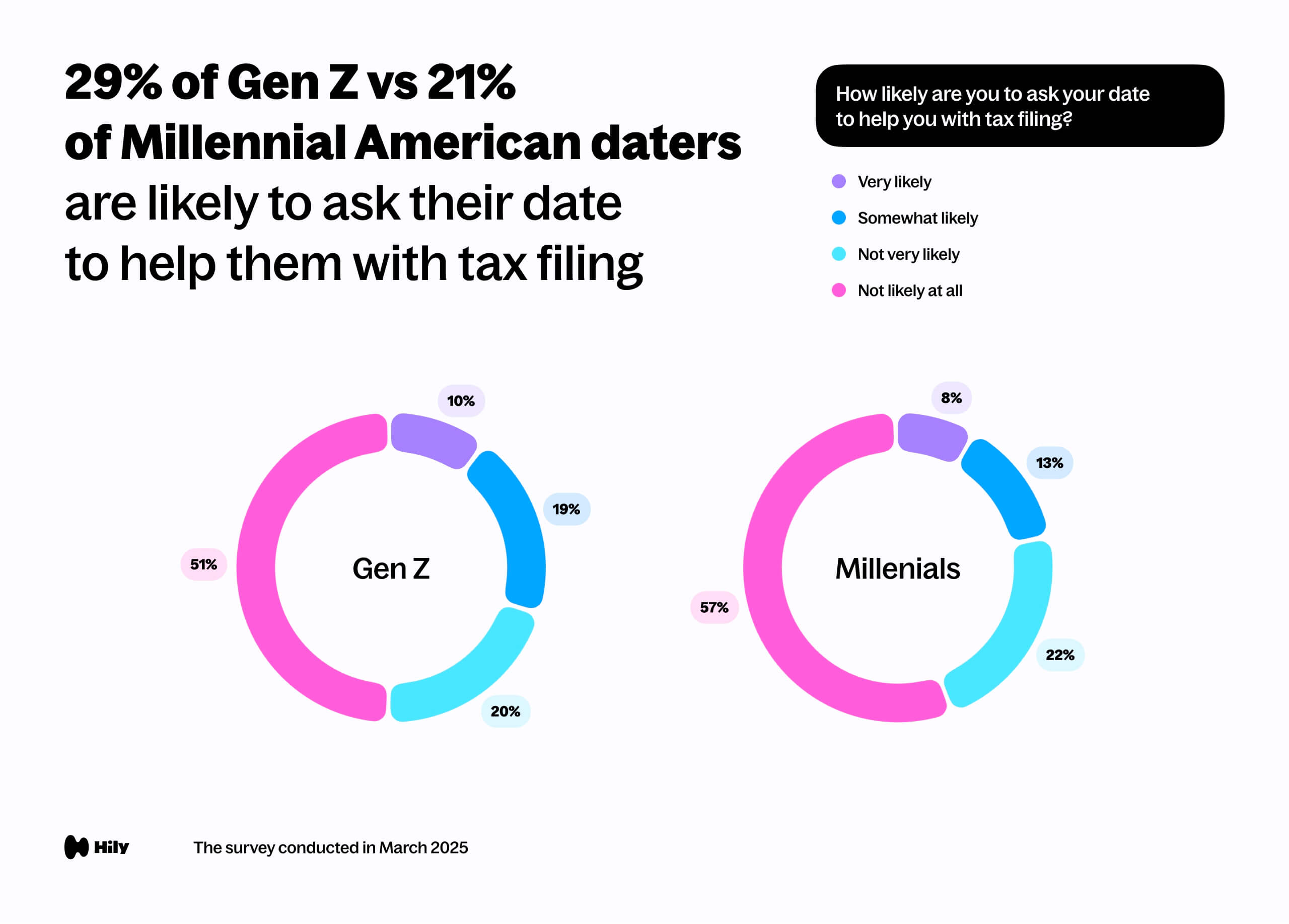

In general, Gen Z seem more likely to team up with their dates and partners to tackle taxes, as compared to Millennials. Among Gen Zers, 29% say they’re likely to ask their date for help filing their taxes, with only 21% of Millennials saying the same.

In line with favoring dates who file their taxes early, young Americans seem to increasingly favor those who can file their taxes on their own. In fact, as many as 1 in 3 consider those who do their own filing sexier than those who have someone else do it.

Among women, that number is a little higher: 33% consider those who file their own taxes sexier, while 13% disagree. Men have less strong opinions on that: 30% agree, and 8% disagree.

Conclusion

As Tax Day approaches, young American daters think about their taxes. Their tax filing habits do influence their dating preferences and habits somewhat. Many consider people better partners if they’re responsible with their taxes and can file them on their own. A significant percentage even looks for tax professionals on dating apps specifically to have a partner that could help them with filing.